blog Money Personal Finance | 5min Read

Published on February 12, 2022

Wishing you all a very happy new year! Like every other new year, you probably are coming across tons of posts on social media, advertisements, TVs and even your family members would have asked you at once – “What’s your New Year Resolution?”

Still in dilemma, are you?

Setting resolutions and following them seems like a difficult task, right? Let’s try setting goals that you want to achieve this year! Then, the things you need to do to achieve these goals, become your resolutions for the year. Simple?

Think about your top 3 goals this year.

Now, write them down on a piece of paper.

Ask yourself – Do any of these goals involve developing money management skills?

If yes, you’re in the right place! If not, maybe you need to understand this! Think about it – this is probably the first time you are being told to plan about money while setting your new year’s resolutions, isn’t it?

While students plan to create general resolutions related to their school, grades, extra-curricular activities, learning a new sport or hobby, staying fit, etc. they often forget about one of the important aspects, i.e. finance and money.

It’s high time you embrace money management skills and the best way to do so is by incorporating them into your new year’s resolutions! So, let’s have a look at these unique financial resolutions and how they are going to change the course of your financial journey this year.

Why Should You Set Financial New Year Resolutions?

Buying a new gadget, starting a new project, eating healthy and staying fit, going on a thrilling adventure, etc. have been some of the most common new year resolutions you’d come across. But this year, you can literally live by the popular “New Year, New Me.” saying, and set an example for your friends! Finance plays a pivotal role in everyone’s life and you can be the pioneer who sets financial resolutions this year! These resolutions will not only help you this year but will also prepare you for years to come.

5 Financial New Year Resolutions For Students

1. Save More. Worry Less.

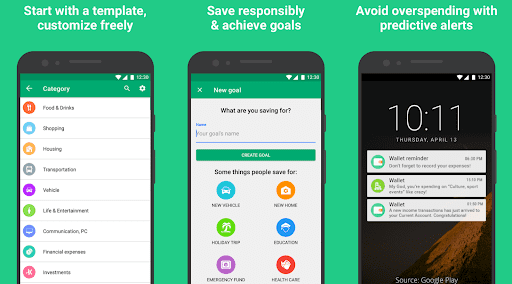

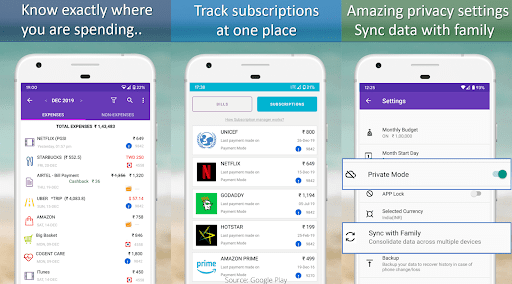

Undoubtedly, the top financial resolution is saving more money. The first step starts with tracking your expenses, pocket money, and how much money you can save every month. Later, you can cut down your spendings on food, books, subscriptions, and other basic amenities. You can look for student discounts while spending on daily needs. Remember to “Pay yourself first.” i.e. “paying” your future self. Because if you pay yourself last, chances are, you won’t pay yourself at all. So, the next time you receive your pocket money, make sure you save wisely.

2. Budget, Budget, Budget.

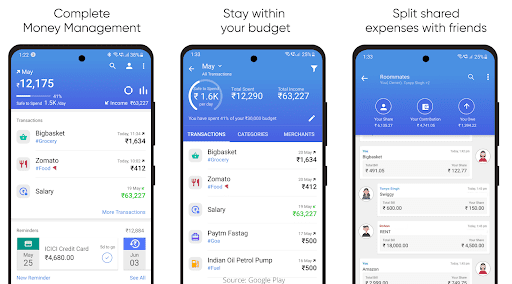

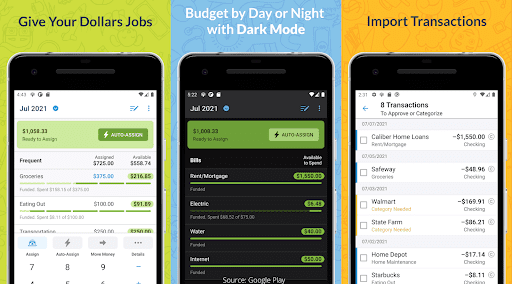

Set a monthly budget for better money management and keeping good track of each and every expense. Develop your own financial plan by doing an analysis of your income/pocket money, expenses, and investments. Or if you have trouble sticking to a budget, you can make a spending plan instead, that will offer you more freedom and peace of mind. You can opt for the old-fashioned way with a pen and paper, or choose a money management and budgeting app that will serve your purpose. Having a foolproof and good budget will determine your financial success for the year, so pay special attention while making one!

3. Start Investing Right Away

Initially, many students are afraid of investing as they lack the proper knowledge on where, when, and how to invest their money. But once you explore and find out about the investment plans for students, you can gain confidence and start investing in the right way. Mutual funds, stocks, cryptocurrencies, etc. are some of the best investment options available. Set a monthly target of investing Rs. X, regardless of what’s going on in the markets. Therefore, a regular and systematic investing approach will help to achieve your financial goals and set a strong foundation for the long run.

4. Start An Emergency Fund

Apart from savings, investing, and managing your money, an emergency fund is one of the most important financial aspects that will help you with unexpected expenses. This fund should be designed specifically such that it would help you to withdraw the money whenever you need it without any delays. It cannot be built overnight, but gradually by setting aside some amount every month in a different bank account. Also, it’s fine to cut down on investments while building this. Experts often recommend having three to six months of living expenses as an emergency fund, and investing it in liquid funds as it provides better liquidity and higher returns compared to bank savings accounts.

5. Learn And Grow

As they say, “A little knowledge is a dangerous thing”. Make sure that you don’t just learn from a few resources and call yourself a financial expert. It’s a long journey, thereby understanding and having knowledge on all finance-related things is extremely critical to building wealth. You can learn and do your research through plenty of sources like finance newsletters, personal finance books, best finance podcasts for beginners, online classes, financial literacy courses, and more. Explore these resources in-depth as you can to clear your basics on personal finance, budgeting, investments, etc. Taking one step at a time will help you with your financial plan and these resolutions can act as a checklist to make brilliant progress in your financial journey this year.

Final Thoughts

Be it these financial resolutions or any other resolutions that you have planned for 2022, you are bound to have some obstacles coming your way. There will be times when you just feel like giving up and changing your path, but believe us that’s just a phase and it will pass. Don’t try to follow 50, 100, or 200 resolutions, stick to just one or two, and try to achieve them. So, say au revoir to 2021 and embrace 2022 by sticking to these financial resolutions and fulfilling them this year! Will you? Come, join hands with Big Red Education and complete your new year financial resolutions together.

P.S. Good financial resolutions aren’t always related to saving money and investments. Resolving to donate to a worthy cause in 2022 is a magnificent way to spread positivity and make a difference. Take some time to research some of the notable charities in your locality and try helping out the ones in need. Your small actions can go a long way!

Ready with your resolutions now? Don’t forget to share them in the comments below!