blog Personal Finance | 7min Read

Published on April 6, 2022

The 52-Week Money Challenge for Students

“Do not save what is left after spending, but spend what is left after saving.”- Warren Buffet

When you have money in hand, you’ll find a hundred ways to spend it. But in how many ways can you save it? The abundance of savings you have goes hand-in-hand with your financial independence. There are a lot of categories of saving plans to improve your financial stability. Still, often, it’s difficult to find an efficient money-saving plan for students that is easy to follow and can help you save money consistently.

Folks, it’s time to forget the complicated saving plans because we have a challenge for you!

Did you know you can save Rs.1,37,800 by starting to save just Rs.100 a week in one year? And you can buy one brand new MacBook Pro or two latest iPhones with this money! Sounds a bit confusing and tough to believe, right? But that’s the magic behind this 52-week challenge! So, hop on to discover more about this challenge.

What is the 52-Week Money Challenge?

Money challenges can make the whole concept of a money-saving plan for students more fun and give them the much-needed motivation to save even more. The 52-week challenge is a strategic approach to save a certain amount every week over a period of 52 weeks, i.e. one year. If you keep up and follow it throughout the year you’ll end up saving a good amount of money in the end.

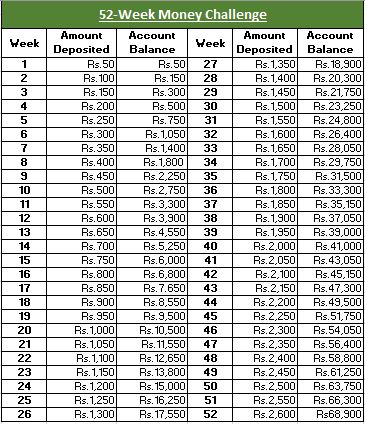

For the 52-week money challenge, you can start by saving money in multiples of Rs. 50 every week. You save and keep aside Rs.50 in your first week, Rs.100 in your second week, Rs.150 in the third week, and you’ll end this year by saving Rs. 2,600 in the final week. If we add up these total savings, it would be Rs. 68,900.

Check the sheet below to understand the amounts of money you will be saving every week, throughout the year.

You can use this planner as a checklist to keep a track of the amount of money you are saving each week.

How to Get Started and Stay on Track?

So, the very first thing to start with is deciding where to store your savings. It’s advisable to keep the money in your bank account. You may consider opening a high-yield savings account and transferring the money every week from your main account. You can automate the process by getting in touch with the bank officials, making it easier for you.

To stay on track you have to consider a couple of points:

- Set reminders on the calendar and get weekly notifications so that you don’t forget about the challenge. Money management apps can come in handy in this case.

- To get some extra motivation, set certain benchmarks for yourself like rewarding yourself at the end of every 5 or 10 weeks.

- Ask your family members and friends to take up the challenge. Keep checking on each other on a monthly basis to ensure you’re keeping up with the challenge.

How to Make it Work?

If you take a look at the challenge sheet, you’ll see that you start by saving Rs. 50, Rs. 100 and so on per week. But by the end of the year, you need to be saving Rs. 2600 in a week. How to save this amount of money?

- 52-weeks is a long time, and you need to take small steps to reach the end. You can start by limiting those frequent visits to cafes, fast food restaurants, and eating inside. This will help you to save some of your pocket money for the challenge.

- While ordering pizza next time, maybe cancel on that extra cheese burst and toppings that would fulfill the initial weeks of the challenge.

- A huge amount of money is to be saved in the last quarter of this challenge. For the last 3 months, you can start cutting down on some unnecessary subscriptions or outings. Utilize that time to learn and grasp financial literacy crafts that would help you to make some extra money.

- Inform your parents that you’re taking this challenge up and ask for their assistance in the last 3 months if you’re falling short of the challenge money.

- Make use of those hefty student discounts and save money on academic courses, software, travel, food, retail, etc.

- Prepare your monthly budget accordingly by keeping the challenge in mind, and the money you would dedicate every month towards it.

- Is saving regularly enough? It can be. But what’s better is that you can make this money grow. Start studying about investment options available for you as a student, set a target to invest a specific amount after every 4 weeks, and watch it grow as you progress further.

Even after this, if you feel that starting with Rs. 50 is not feasible for you, don’t worry! You can start saving only as much as 10 bucks a week as well. Just building the habit of saving is important.

Have a look at the image below to understand how much money you would save in 52 weeks if you start with Rs. 10, Rs. 20, Rs. 30, etc.

The ball is in your court now, on what amount to start with, when to begin and how you would bring the best out of this challenge for yourself.

Benefits of the 52-Week Money Challenge

Alright, we hear you! Savings are important and you are well aware of that. But why should you follow the 52-week challenge? Let’s have a quick look at the top 3 advantages of the 52-week challenge:

- By taking up this challenge, you are taking small steps towards your savings plan and financial goals for the future. A huge sum doesn’t just appear in your account one day out of nowhere. It has to be built consistently. The challenge helps you to save a larger amount by starting small.

- Though you’re starting small, you can gain momentum slowly and notice results as each week passes by. This would motivate you to save more and encourage you to develop a long-term financial habit.

- Taking small actions is always more convenient. Rather than saving large amounts like Rs.2,000 or Rs.5,000 at the end of the month, you can focus on saving small amounts like Rs.30 or Rs.300 every week, without taking any extra load.

- The challenge is surely going to check your perseverance. So, instead of spending on things that give you immediate gratification, you can delay your spending and end up buying something substantial for yourself.

Tips for Completing 52-Week Money Challenge

Now that you know what is the 52-Week Money Challenge and the benefits it offers, here are some exclusive and fantastic tips from Big Red Education that will help you to complete this challenge:

Tip Number 1: Pre-plan the amount to save along with your budget

While creating your monthly budget, calculate the amount that will go towards this challenge that month. Once you have it pre-planned, you can manage your other expenses accordingly and won’t face any issues by month-end.

Tip Number 2: Reduce your expenses wherever possible.

You won’t just end up with a large amount without cutting down your expenses. So, keep an eye on your daily expenses and avoid things that urge you to spend money. Start small by avoiding that extra cheese slice on your burger or taking an extra cup of cold drinks while you eat outside, and gradually you’ll save up money for the challenge. You can also gain some extra money by selling things that you don’t need.

Tip Number 3: Stay motivated and stick till the end.

The challenge is not meant to be easy for sure, so even if you have a few misses in between, that’s completely okay. Remember that you have already accomplished the most difficult part – getting started. Pat your back for that, and save whatever amount possible every week. You can save even in multiples of your favorite number and make things interesting.

When to Start This Challenge and What to do With the Savings?

The most ideal time to start this challenge is at the start of the year along with your New Year Financial Resolutions. This helps you to keep track of both things simultaneously. However, this is not a rule, and you can literally begin with your challenge whenever you feel like taking one! The key is TO START, and you already have passed it!

The amount that you save through this challenge can be used as an emergency fund, sinking fund, or even investment. You can also do something fun for yourself like buying things that are on your wishlist for a long time or planning a vacation for your family.

By taking this challenge, you are starting to build a strong financial base for yourself that will act propel you toward your dreams. Continuing to invest this money for the next few years can help you build a good sum and contribute to your university expenses or entrepreneurial endeavors.

Try out the 52-Week Money Challenge Now!

Needless to say, this 52-week challenge is just the first step toward a giant leap in your personal financial journey. It is an excellent opportunity to improve financial management skills, build money management skills for the future, and get used to financial goals. If you complete this challenge, do celebrate. But remember to save further and use this experience as a springboard for achieving your other financial goals.

Looking for more such challenges and interesting things to learn about the financial world? Connect with Big Red Education now and take a step towards your financial journey.