blog Money Personal Finance | 6min Read

Published on December 22, 2021

5 Amazing Financial Literacy Apps for Money Management

Not everyone around you is an expert when it comes to finance and money. People will tell you several answers to the question “What to spend money on?”, but often find it hard to answer the real question- “Where did I spend all the money?”

Did you ever observe how your grandparents used to track money, and how your parents are taking care of their finances right now? If yes, what’s the major difference that you’ve seen? It’s technology! They lacked the technical resources and technology to manage their finances. Your parents never got money from grandparents with just a few taps on their smartphones, and neither did they get the right platforms while they were at school to learn about money management skills. In today’s tech-savvy era wherein everything’s available right on your smartphone, why not choose the smart option to manage your finances as well?

Why Should You Use Apps For Money Management?

Just like the fitness app on your phone that shares data about your health, workout, steps walked, and other activities; money management or personal finance applications help you to track your expenses, savings and prepare you for the financial world. Such apps allow you to make better plans on what to do with your money, where to spend, how to invest, and much more.

Making a budget, tracking expenses, minimizing spendings, and investing are some of the good practices that make you financially smart. Many times, people often miss keeping a record of their transactions and struggle with their daily money management, thus creating havoc in the future. And in times like these, money management apps can provide us the necessary helping hand we need. Using financial literacy apps not only simplifies the whole process but provides you with great money management tips.

Time to get real now. Planning your finances and saving money for your retirement plans right in your teenage years seems a little boring, right? Wrong! Handling personal finance can be super interesting and we’ve got it covered for you! Let’s have a look at some of the best financial literacy apps that would help you become financially smart at an early age.

The 5 Amazing Apps You Need To Download Right Now

Before we start, here’s a quick riddle for you – “If money really did grow on trees, then what would be everyone’s favorite season?”

Still scratching your head? The answer is hidden in the article, all yours to find it! But let’s start with the 5 apps first –

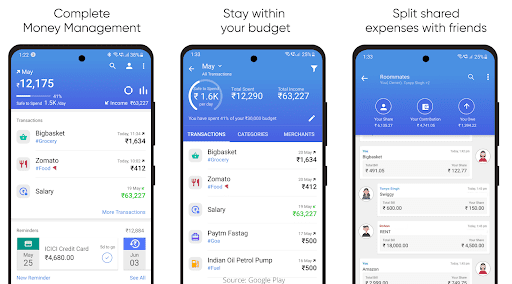

1. Walnut

Walnut allows complete money management by automating your monthly transactions, expenses, and income. It analyzes your transactions through SMS, online billings, bookings, etc. The app provides utmost visibility with auto-categorized transactions and helps you to stay within your budget.

Another amazing feature of Walnut is that you can split shared expenses with friends and tell you how much you contributed and how much you owe. You can also export your information and create expense reports in no time.

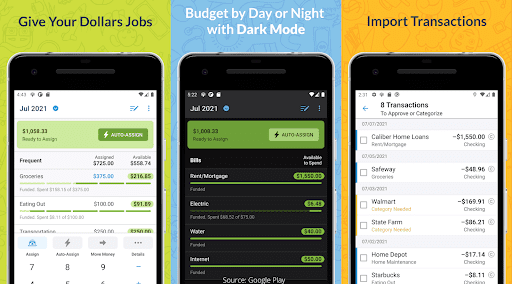

2. YNAB (You Need A Budget)

YNAB allows you to visualize your spending and progress with budget reports. It securely links your bank account giving you a complete overview of all our transactions. Another great feature of this app is that there are no ads at all, and has an auto-renewable subscription model.

With this best budgeting app, you have real-time tracking of your financial goals, modify and share across with anyone. It has an inbuilt loan calculator as well that gives a complete picture of interest and time to pay off the debt. According to YNAB, users save an average of $600 by their second month and more than $6,000 during their first year.

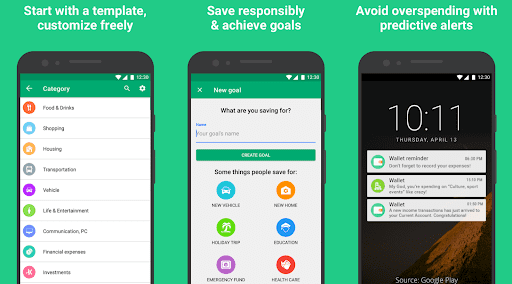

3. Wallet

Through Wallet, you can gain full control of your finances and easily track your spending, budget, and save more money. With continuous financial insights, you can dive into weekly spendings, manage debts, and plan for future money management by centralizing all your financial needs.

You can simply choose a template of your choice and customize your budget, view the upcoming payments and how they will impact your cash flow. Wallet helps you avoid overspending with predictive alerts, and stay in complete control of your credit.

According to a BusinessWire study, 83% of the people that set financial goals, feel better about their finances in just a year. Try it for yourself – your goal could be your favorite watch or your dream college. Start working towards it right away!

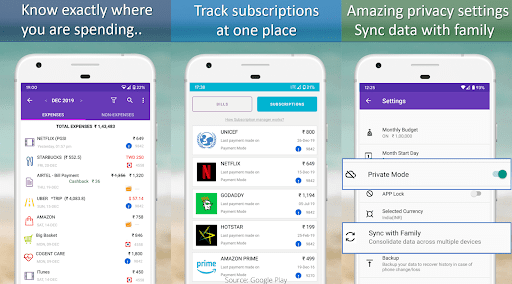

4. FinArt

FinArt is money management and tracking app that gives you monthly bill reminders and can be used together with your family. Yes, you can avail 5-day free trial and then subscribe for as low as 799/year. One of the benefits you get with this app is that of a Family subscription that allows you to use this app for 2 devices, and a Business subscription that helps you manage business accounts separately.

As soon as you download the app, it crawls through your SMS data and compiles all the expenses on one screen. You don’t have to spend hours remembering where you spent money – the app does it all! How cool is that?

The app categorizes your spending patterns, sets a budget for every category, and has a remarkable privacy setting to protect your data.

5. Monefy

Monefy is an easy, efficient, and user-friendly app that helps you with daily budgeting and expense tracking for excellent money management. It compares your expenses with the monthly income and shapes them accordingly to help with savings.

Not just that, but it provides a detailed overview, handy widgets, and records. You can sync your Google Drive or Dropbox safely and protect your data with a passcode.

And here’s the answer to the riddle – ‘Fall’! Did you guess it right? How about you test your friends with this one?

Things to Consider before Downloading Financial Literacy Apps

Today, there are plenty of apps available on the internet related to personal finance, money management, financial literacy, and more. But before you choose and start using the right one for yourself, here are a couple of things we suggest you consider:

- Download the app only from secured sources like Google Play Store or Apple App Store. Make sure to not click on unverified links and download from any unsafe source.

- Check if the app is free or charges the users to access its features. If it has in-app purchases, make sure that it provides safe transaction options.

- Check the app user interface and see if it’s user-friendly and has a good number of beneficial features.

- Ensure it is from a reliable source, and be careful about any personal data such as contact details, photos, emails, messages, etc. on your phone.

Final Thoughts

Not just for managing your money, these apps provide newsletters and information about other financial resources that will help with budgeting, saving, investments, and much more. Each platform is different and has extensive features of its own, but their ultimate goal is the same- making the end-user financially literate and instilling money management skills.

While we have listed out some of the best financial literacy apps for students, there are plenty of others out there as well. So, all you need to do is do some research on the apps that pique your interest and choose the right one that ticks your boxes for money management.

Will downloading and using these apps make you financially literate? Certainly not. It’s just a part of the process and there is a lot more to explore and learn to call yourself that. So, stop procrastinating about it when you can do it now! Head over to the other insightful articles in this section and discover more about the world of finance right away or simply join our student financial literacy course to become an expert.